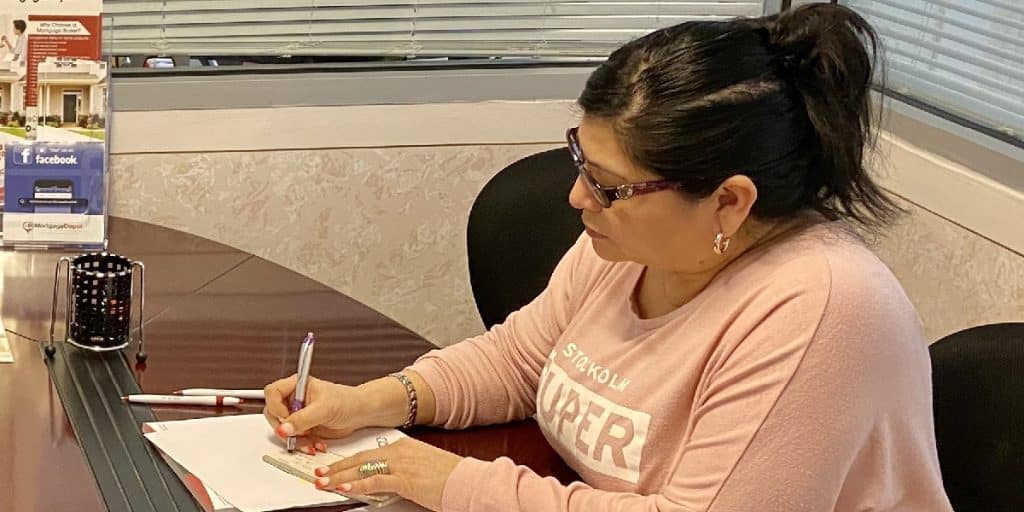

Mortgage Loan Originator, Julia Knurova, worked on behalf of the borrower to structure the loan for a non-warrantable condo, which comprised of an ARM loan at a lower rate with 80% financing, and a larger gift fund than usual with a few conditions added.

When a condo has been classified as non-warrantable, it means that it does not meet conventional lending guidelines. This can make it harder to finance because many lenders consider financing a mortgage for this type of property to be too risky which was the case on this deal. The borrower, was a first-time homebuyer and a non-permanent U.S. resident. They contacted MortgageDepot after being turned away from a retail lender once they realized the condo was deemed non-warrantable because it did not have the necessary reserves. This transaction was difficult from the start since almost all of the funds used were gifted and the condo being non-warrantable added another layer of challenges. Fortunately for the borrower, no matter how complex the scenario seemed, MortgageDepot was able to deliver the best possible outcome for them.

At MortgageDepot, our mortgage professionals aren’t just about brokering a good mortgage deal, their commitment is to represent the interests of their clients with zealous — to help them achieve their financing goals — regardless of how challenging the loan scenario may be. Julia Knurova is a valued team member at MortgageDepot and has a long-standing history of providing each of her clients with hands-on assistance throughout the mortgage application process.

To learn more about our non-warrantable condo mortgage, contact one of our specialists.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!