NONI News: Exciting Changes to This Business Loan Program

Are you looking for a creative way to fund your next residential real estate investment purchase? Wouldn’t it be nice if there were a streamlined loan option with minimal requirements and a fast turn-around time? Whether you are an experienced residential real estate investor or are new to the game, pull up a chair. We have some exciting news to share about NONI loans!

What Is a NONI Loan?

NONI stands for “No Owner No Income.” A NONI loan is used for business purposes in real estate. This program is designed for borrowers to fund the purchase of residential investment properties that have between one and four units.

If you’re seeking a NONI loan, your search is over. MortgageDepot offers this innovative loan program to our valued clients who want to expand their investment portfolios. Keep reading to see if a NONI loan will get you closer to achieving your goals.

Why Our Clients Love NONI

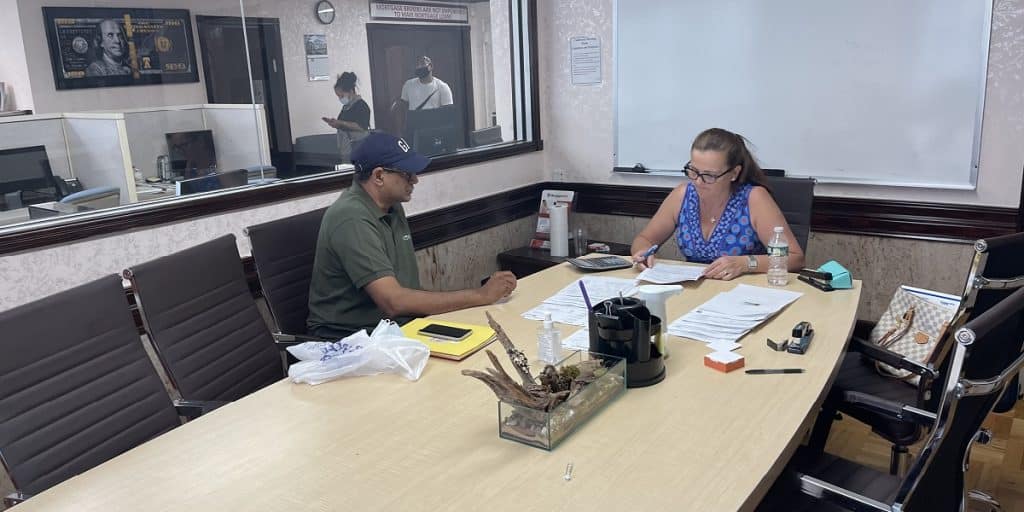

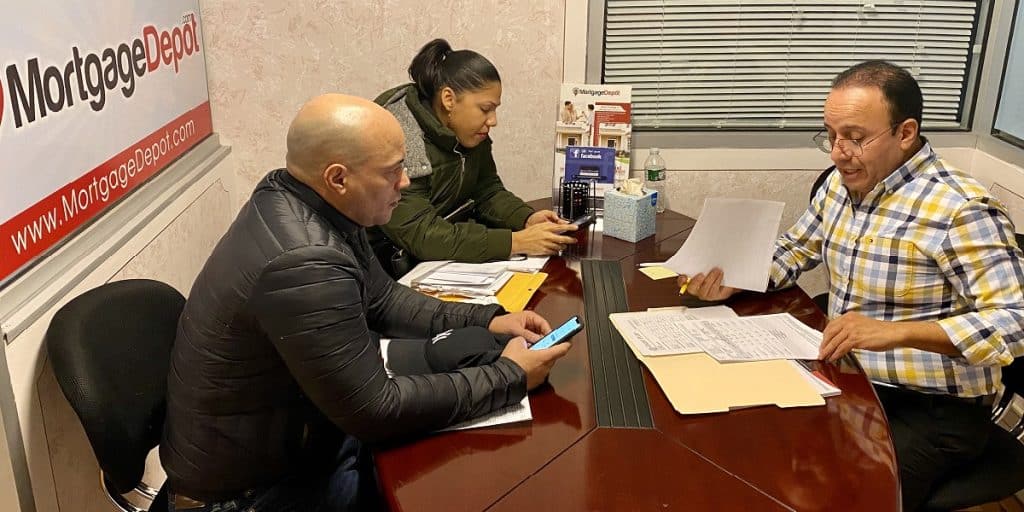

When we sit down with our clients to analyze their mortgage needs, we often find that NONI loans are the right fit for residential property investors. Here are some of the program’s highlights:

- Loan eligibility is based on property cash flow rather than personal income.

- The NONI application does not require income or employment information.

- Borrowers with a credit score as low as 620 are eligible for a NONI loan.

- In most cases, NONI loans process quickly!

- NONI loan interest rates currently begin at 4.125% (this figure is always subject to change).

- This program requires minimal paperwork. Borrowers do not need tax returns, W-2s or pay stubs to determine loan eligibility.

- NONI accepts first-time investors.

- Borrowers are eligible for up to $3.5 million to fund their property purchase.

- Some borrowers can take advantage of this program without cash reserves. In this situation, a cash-out transaction will qualify as reserves.

- This program offers unlimited cash-out below 75 LTV.

What’s New With NONI?

What about that exciting NONI news that we mentioned? Here are the updates that you need to know:

For NONI purchase and rate/term refinance transactions:

- The maximum LTV is now 85%, with a minimum credit score of 680.

- The maximum LTV is now 80%, with a minimum credit score of 660.

For NONI cash-out transactions:

- The maximum LTV is now 80%, with a minimum credit score of 680.

- The maximum LTV is now 75%, with a minimum credit score of 660.

That’s not all that’s happening with NONI loans. Here are a few more noteworthy changes to the program:

- Maximum loan amounts have increased across the board.

- Borrowers who plan to use the property in question as a short-term rental now need only one year of experience.

- Borrowers can use business funds to qualify as long as they own at least 25% of the company.

MortgageDepot Is in the Know!

Real estate is a constantly-evolving industry. At MortgageDepot, it’s our job to keep up with the changes. If you plan to purchase a residential investment property, contact us today. We’ll help you determine if the NONI program will accomplish your goals!

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!