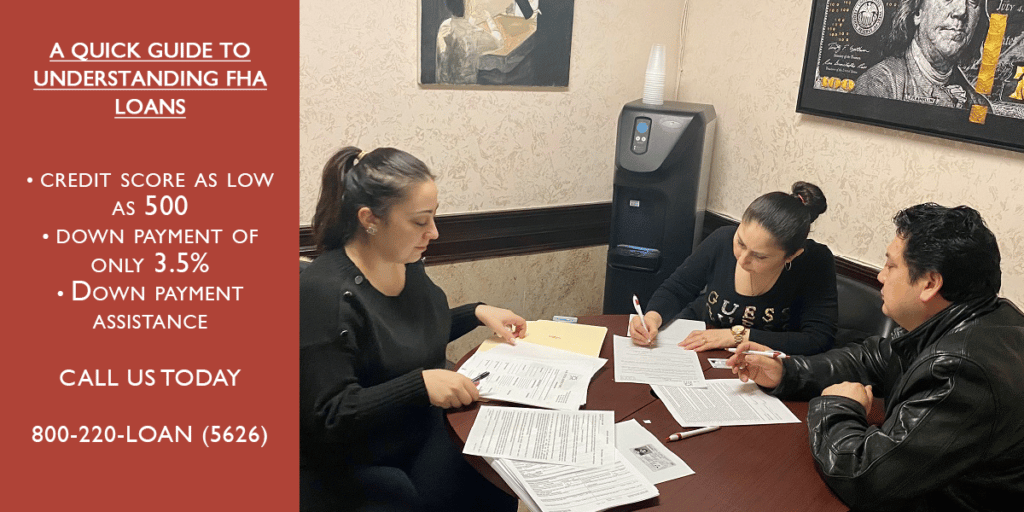

When it comes to FHA loans, borrowers need to be aware of the guidelines regarding collection accounts. In this blog post, we will discuss the two options available for borrowers with collection accounts and how it affects their debt-to-income (DTI) ratio.

Option 1: Paying Collection Accounts in Full

According to FHA guidelines, if a borrower’s collection accounts have a cumulative balance of $2,000 or greater, they are required to be paid in full. This means that the borrower must settle all outstanding debts before they can qualify for an FHA loan. By doing so, the borrower demonstrates their ability to manage their financial obligations responsibly.

Option 2: Including Collection Accounts in DTI

Alternatively, borrowers have the option to include 5% of the balance of their collection accounts in their DTI calculation. This means that even if the collection accounts remain unpaid, the borrower can still qualify for an FHA loan as long as their DTI ratio meets the required guidelines. This option provides flexibility for borrowers who may not have the means to pay off their collection accounts in full.

Considerations for Borrowers:

It is important for borrowers to carefully evaluate their financial situation and choose the option that best suits their needs. Paying off collection accounts in full can improve their creditworthiness and potentially result in a lower interest rate. On the other hand, including collection accounts in the DTI calculation allows borrowers to proceed with their loan application without the immediate burden of paying off their debts.

Understanding FHA guidelines regarding collection accounts is crucial for borrowers seeking an FHA loan. Whether they choose to pay off their collection accounts in full or include them in their DTI calculation, borrowers should consult with one of our loan officers to determine the best course of action. By adhering to these guidelines, borrowers can increase their chances of securing an FHA loan and achieving their homeownership goals.

Contact our office for more information about obtaining an FHA loan.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!