If you are among the many homebuyers who will rely on a mortgage loan to pay for your purchase, you understandably may plan to hunt for financing after you find a home. After all, it could take months to find the right home, and a mortgage prequalification letter is only valid for limited time. While this strategy seemingly makes sense on the surface, the reality is that you can enjoy several key advantages when you get prequalified upfront.

Narrow Down Your Home Search

Many of today’s homebuyers utilize online calculators to determine affordability before searching for a property. While these are excellent introductory tools, they will not tell you with certainty what loan terms you could qualify for. Searching for a property without knowing what your sales price range is could establish misleading expectations. For example, if you initially only look at houses far above your means, you may be disappointed when you look at the homes that you could actually afford. You can save time, energy and frustration related to your search when you understand what your finance options are.

Present a Strong Offer to the Seller

When a seller accepts an offer, the seller essentially is taking the property off the market. While some buyers may still tour the home and submit backup offers, the seller is committed to offer that he or she has accepted. Because of this, sellers often want to see a prequalification letter before accepting an offer. This gives the seller confidence that the buyer can qualify for essential financing and that the purchase may be processed without hassle. In the event that the seller receives multiple offers at the same time, the offer that is submitted with a prequalification letter could be viewed more favorably by the seller.

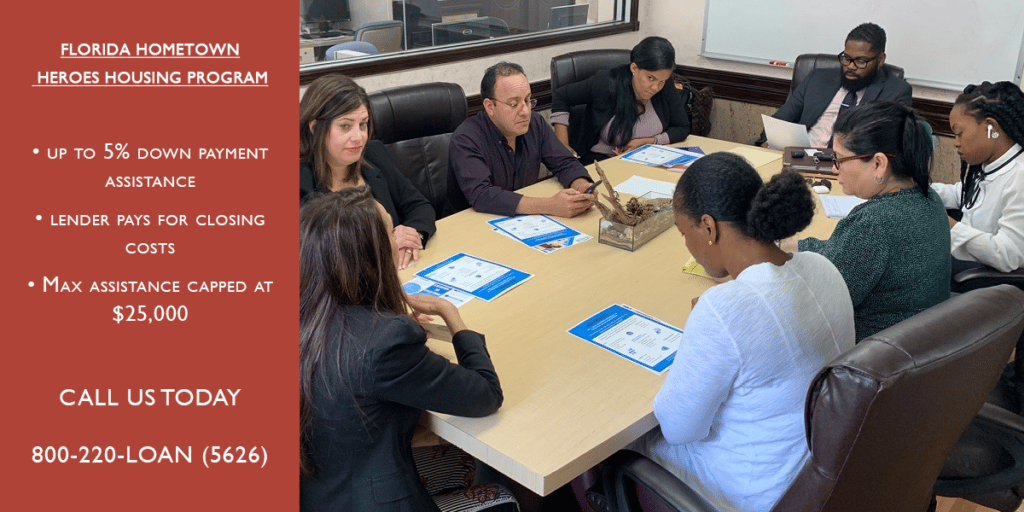

The prequalification process sounds stressful and time-consuming, but it can usually be completed within a few hours or less. In the event that the prequalification letter expires before you find a suitable property, your lender can update the prequalification and issue a new letter.

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!