Down payments, interest rates, closing costs and more … When you’re buying a home, it all adds up. When you add PMI to the mix, it might affect your ability to purchase your dream home.

At MortgageDepot, we understand the financial challenges of buying a home. PMI is one of those challenges, but we can help you overcome it with innovative loan programs that meet your needs and help you stay within your housing budget.

What is PMI?

PMI stands for private mortgage insurance. If you are applying for a conventional loan and don’t have 20% of the purchase price to hand over for the down payment, you’ll need to pay PMI.

PMI usually amounts to between 0.5% and 1% of the home’s purchase price. Your PMI payment is typically tacked onto your monthly mortgage payment. Once you’ve paid enough of the principal on your mortgage, you can get the PMI portion of your monthly payment removed.

Why Do I Need To Pay PMI?

If you don’t have 20% to put down for a conventional mortgage, your mortgage poses an increased risk. Therefore, PMI is added to your monthly mortgage as an additional layer of protection for the lender. A word of warning: PMI does not offer borrowers any protection. If you fall behind on your PMI payments, you could lose your home to foreclosure.

Avoiding PMI: Is it Possible?

We offer a strategic way for borrowers to avoid PMI. This program is available exclusively for 30-year fixed-rate conventional mortgages, and it could result in significant savings over the life of your loan. Here are the details:

- Primary and secondary home purchases are eligible.

- This program is designed for borrowers with a loan-to-value (LTV) ratio between 80.01% and 89.99%.

- Borrowers can have a debt-to-income ratio (DTI) of up to 45% to qualify.

- Borrowers must have a minimum credit score of 680.

- Loan amounts for this program start at $200,000.

- A high-balance version of this program is available for mortgages that exceed the county loan limits.

Connect With Us Today!

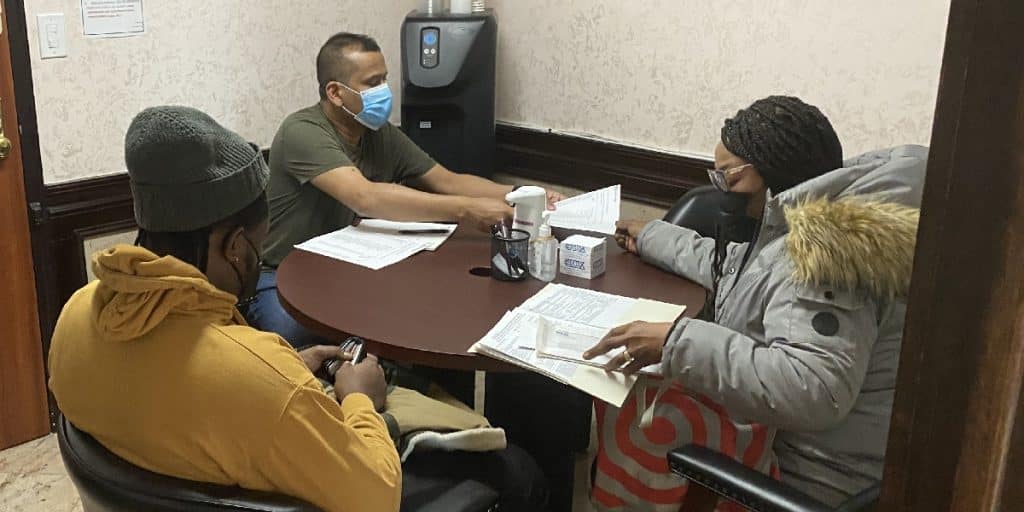

If you think that PMI is in your future, you might have other options. Our dedicated loan professionals offer a personalized approach to the financial aspects of home buying, saving our clients time and money while they continue their journey. Connect with us today to learn more!

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!