At MortgageDepot, we understand that your income might come from several sources. Each client approaches us with a different income arrangement, and it’s our job to help them properly account for their income when they apply for a mortgage.

Sometimes our clients come to us wondering how to use additional income sources that extend beyond their regular paycheck to apply for a mortgage. Even if these income sources are irregular, we still have a plan in place!

Many mortgage programs look at a borrower’s 24-month income history, but sometimes this guideline restricts otherwise-qualified buyers. At MortgageDepot, we don’t always require a 24-month average to use additional income sources during mortgage qualification.

Defining Additional Income

Additional income is tricky to define. The best way to do so is to provide examples. Here are a few of the most common ones:

- Commissions

- Overtime

- Bonuses

- Tips

- National Reserve or National Guard pay

- Unemployment benefits for seasonal workers

Other examples of additional income exist. If we didn’t list your additional income source here, contact us for guidance.

Using Additional Income To Qualify for a Mortgage

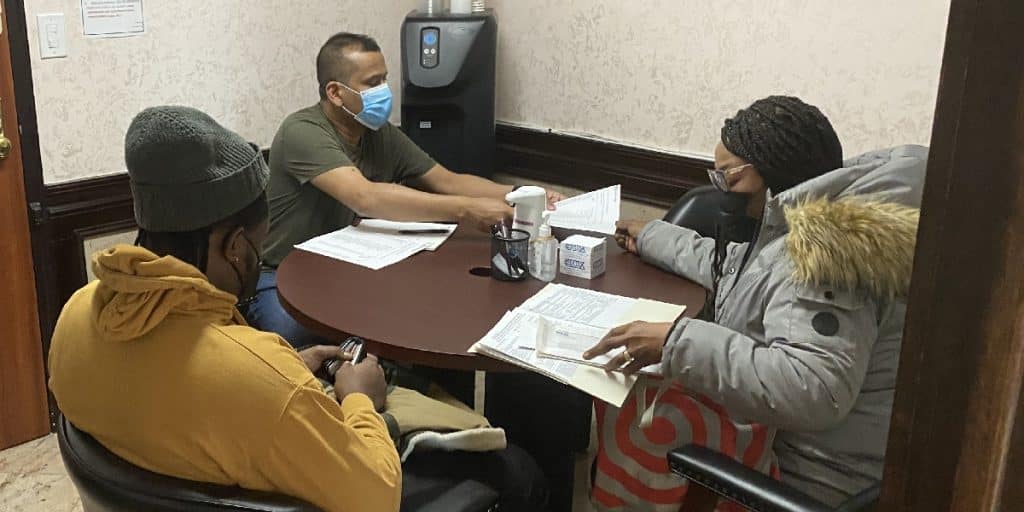

Our experienced loan officers will determine if your additional income will benefit you at the mortgage desk. Here are the guidelines that you need to know:

- If you have been earning additional income for at least 12 months and these earnings are increasing, the income calculation is the most recent year’s and year-to-date’s income divided by the number of months.

- If your additional income has increased 10% or more year after year, Freddie Mac requires the underwriter to conduct an in-depth analysis to determine if you can use the higher amount.

- If your additional income from the previous year is declining, the year-to-date total is used to qualify. If additional income declines by more than 10%, the underwriter conducts further analysis.

Contact Us Today!

Our loan officers are here to help you secure the best mortgage product possible! Contact us today to learn more about using your additional income sources to qualify for a mortgage.

Connect with one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!