If you’ve been doing your research, you already know that Fannie Mae mortgages have specific owner-occupancy requirements. These requirements exist to give potential homeowners, rather than investors, an upper hand in real estate purchases.

As we know, purchasing a home is not always a black and white endeavor. That’s why Fannie Mae offers three special allowances for owner-occupancy. If you do not meet the traditional definition of owner-occupancy, see if your mortgage needs match one of these situations:

- You are one of multiple borrowers. In this case, only one borrower needs to occupy the property and take the title to meet the requirement for owner-occupancy and qualify for a Fannie Mae loan.

- You are planning to purchase a property for your handicapped or disabled child. To meet the requirement for owner-occupancy in this situation, you must provide documentation that your child is unable to work or doesn’t generate enough income to qualify for a mortgage on their own. As the parent, you would be considered the owner/occupant, but you would not need to live in the home full-time.

- You want to purchase a home for your elderly parents. Similar to the previous scenario, you must prove that your elderly parents do not have enough income to qualify for a mortgage independently. Again, you would be the owner/occupant, but the home would not necessarily be your primary residence.

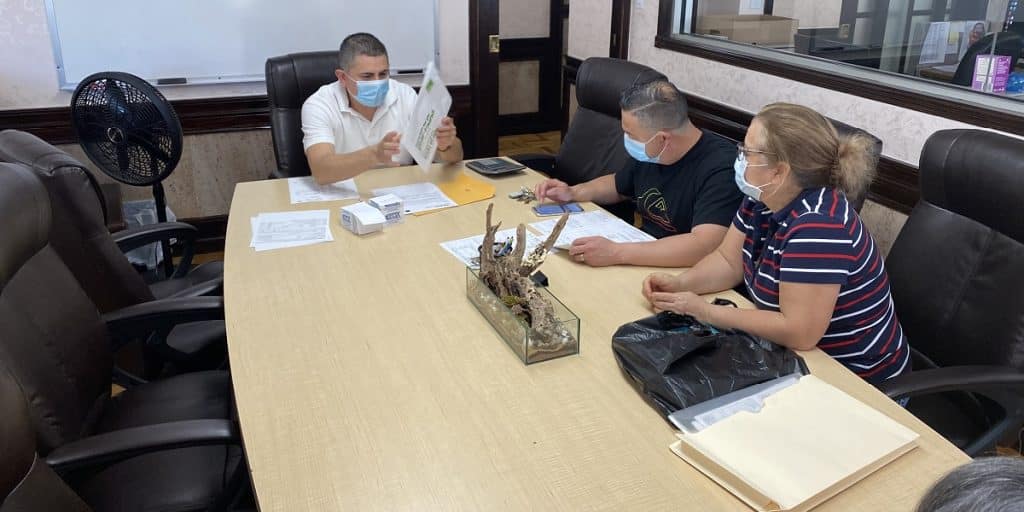

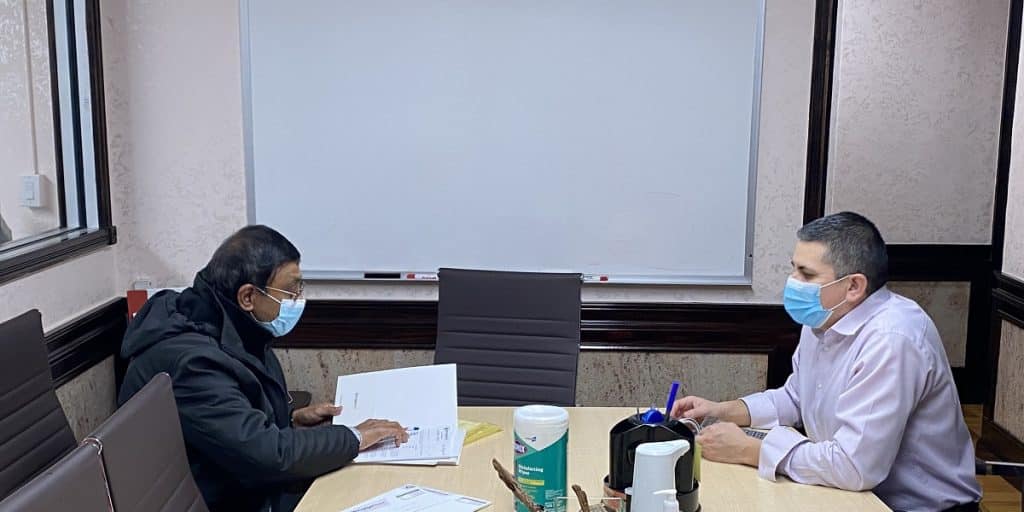

If other mortgage brokers have told you that your options are limited, sit down next to one of MortgageDepot’s experienced loan officers. We have access to multiple mortgage products that address unique situations. Contact us today to find a home loan that works for you!

Connect with one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!