Applying for your first mortgage can seem intimidating. The best way to conquer your anxiety is to learn more about the process. Regardless of the loan program that you apply for, your lender may base your qualification on a few important factors. These include your income, your debt-to-income ratio, your credit scores, your job history and the property. Essentially, the lender wants to make sure the property meets its guidelines. The lender also needs to know that you have the assets and income to cover the debt and that your employment is likely to continue.

One of the best steps that you can take before you start searching for your first house is to get pre-qualified. This is not a full loan approval, but it can give you insight into your odds for approval and the loan terms that you may be approved for. More than that, a prequalification letter can strengthen your offer on a new house. To get pre-qualified, you will need to fill out a loan application, agree to a review of your credit report and submit backup information supporting your stated income and assets.

Once you have an approved sales contract, you can formally apply for the loan. The appraisal will be ordered, the survey will be reviewed and any additional information related to your loan application will be collected by the lender. The file will go through the underwriting process. Once the underwriter has issued final loan approval, the closing documents will be prepared. Once you sign the documents, the property is officially yours.

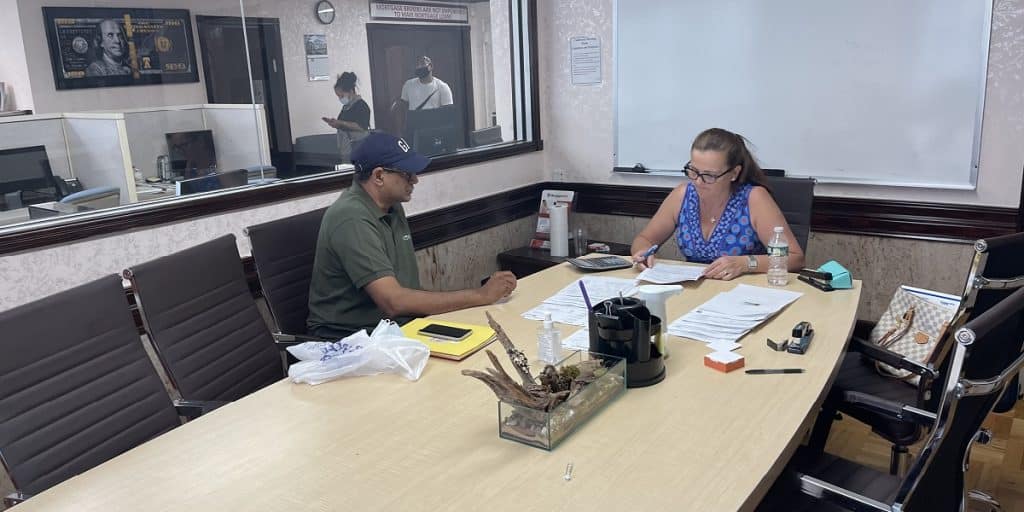

Do you have more questions about applying for a mortgage, or are you ready to get prequalified? Our MortgageDepot associates are available to guide you through all stages of the loan application process. To get started, contact our loan team today.

Connect with one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!