At first glance, a mortgage origination fee may seem like a fluff expense that serves no true purpose. However, like other types of companies, lenders are in the business of making money. They must bring in enough money to cover their overhead, which includes office-related expenses, insurance, salaries, their own rent or mortgage, taxes and more. Lenders provide essential services to loan applicants, and they charge a fee for their services.

This fee will is usually listed on your disclosures and your closing statement as a mortgage origination fee. It may also be called a lender’s fee. Often, it is a percentage of the loan amount. Notably, this fee can be paid through the interest rate. For example, you can agree to a slight increase in your interest rate to reduce or to counter the origination fee. This will be listed on the closing statement as a discount point. If you want to lower the amount of money that you are required to bring to the closing table, this is an effective way to accomplish that.

All lenders charge an origination fee because they must cover their expenses. When a lender advertises a loan as having no origination fee, it may be because it is charging a discount point. As a result, it may be charging a higher interest rate. Either way, you are paying for this expense. As you explore your loan options, it is important to compare interest rates, discount points and origination fees in order to determine the true cost of a lender’s fees. Keep in mind that most lenders are open to making adjustments in these areas to meet your needs.

If the lender charges an upfront fee, this origination fee often will equate to anywhere from a half-percent to a full point. A point is one percent of the loan amount. For a $400,000 loan, this means that you may reasonably pay between $2,000 and $4,000 for the lender’s origination fee.

Keep in mind that the origination fee is only one of several closing costs that the buyer may be responsible for. Other expenses are the appraisal fee, the survey fee, title insurance costs, prepaid taxes and insurance, credit reporting fees and more. Altogether, you can expect to pay up to six percent of the loan amount in closing costs. Be aware, however, that this varies based on your location, the loan program you select and a variety of other factors.

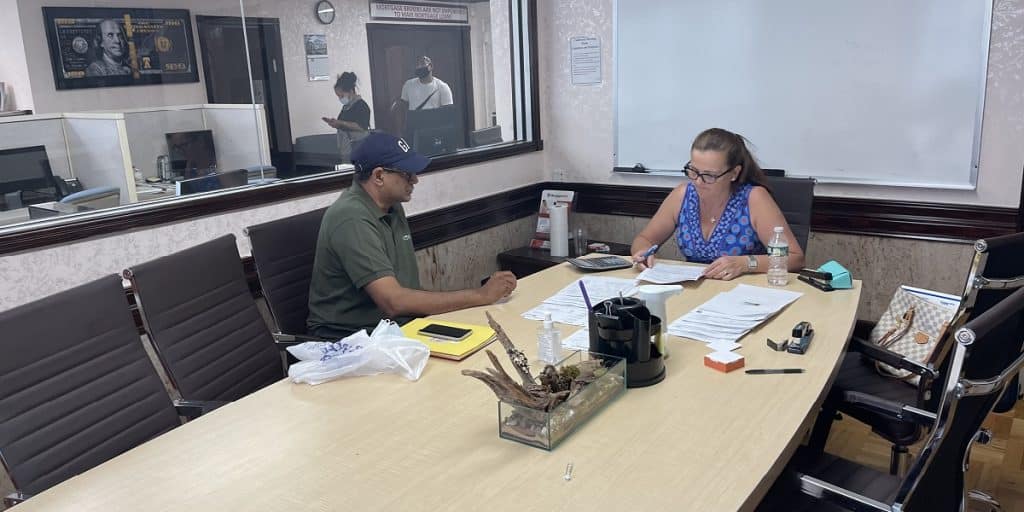

Do you want to learn more about origination fees and other closing costs for different loan programs? Our loan associates at MortgageDepot are happy to help you explore loan programs that may be suitable for your needs. Call or email the MortgageDepot lending team today for assistance with your upcoming loan application.

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!