Some lenders offer one-size-fits-all loan programs. These programs do not meet the needs of self-employed borrowers and others who cannot meet the income-documentation requirements.

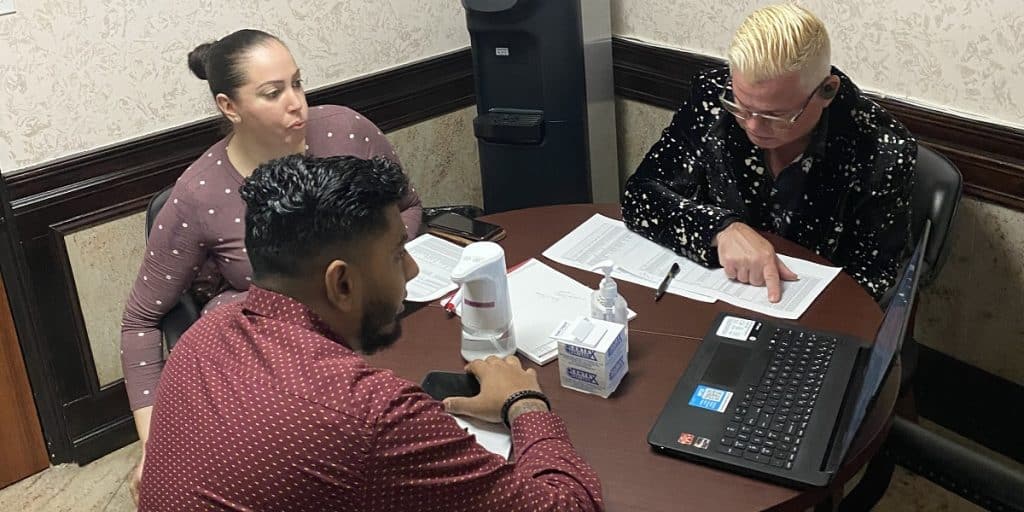

As a multi-state mortgage broker company working with a network of lenders, MortgageDepot has a solution with our owner-occupied no income-check mortgage program.

Expanding loan options for borrowers

Other lenders turn away borrowers who cannot produce the W-2, pay stubs and tax returns necessary to meet the strict underwriting criteria of traditional mortgage programs. Instead of turning them away, we offer a loan program that makes homeownership possible for the self-employed and other individuals with difficult to verify incomes.

Our owner-occupied, no income-check mortgage is a community development loan. As such, we work with lenders requiring little or no documentation verifying income.

Program highlights

We built flexibility into our loan program to make it accessible to more borrowers. For example, borrowers who do not have enough money saved for a down payment may qualify with 100% gifted funds. The loans offer favorable and affordable terms. Other highlights of the program include:

- No tax returns or W-2s required.

- Maximum 50% debt-to-income ratio.

- Minimum FICO score of 660.

- Loans available for up to $3 million.

Borrowers will appreciate our streamlined income and asset verification requirements that allow self-employed borrowers to prepare their own profit-and-loss statement for submission. Instead of multiple bank statements, we only ask for a bank statement covering the most recent 30 days.

Loans are available to purchase or refinance the following types of properties:

- Homes with one to four units.

- Condominiums.

- Cooperative apartments.

- Planned unit developments.

A cash-out option is available for borrowers provided the proceeds are used toward reserves.

Making financing a home accessible to more borrowers

Our team of loan officers has all the details about our owner-occupied, no-income check mortgage and can get borrowers started with the easy application process.

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!