For years, low mortgage rates have spurred homeowners to refinance their home loans. In the process, homeowners have been able to tap into their home equity, lower their monthly loan payment and achieve other goals in great numbers. However, mortgage rates have progressively inched higher across recent months. The demand for mortgage refinance loans has followed suit. In fact, the refinance loan demand has declined by approximately 20 percent over the last 10 months. With interest rates projected to continue rising, the impact on refinance loans may continue as well.

This trend is also present in the demand for purchase loans to a lesser degree. Compared to a year ago, new mortgage applications for purchases have dropped by more than 50 percent. In addition to the higher interest rates, the trend for purchase loans may also be heavily affected by relatively low inventory. In addition, high demand is driving prices in many areas upward dramatically, and this may be pricing some potential buyers out of the market. As the economy continues recovering from the pandemic-related shutdowns and job losses, these market conditions may persist.

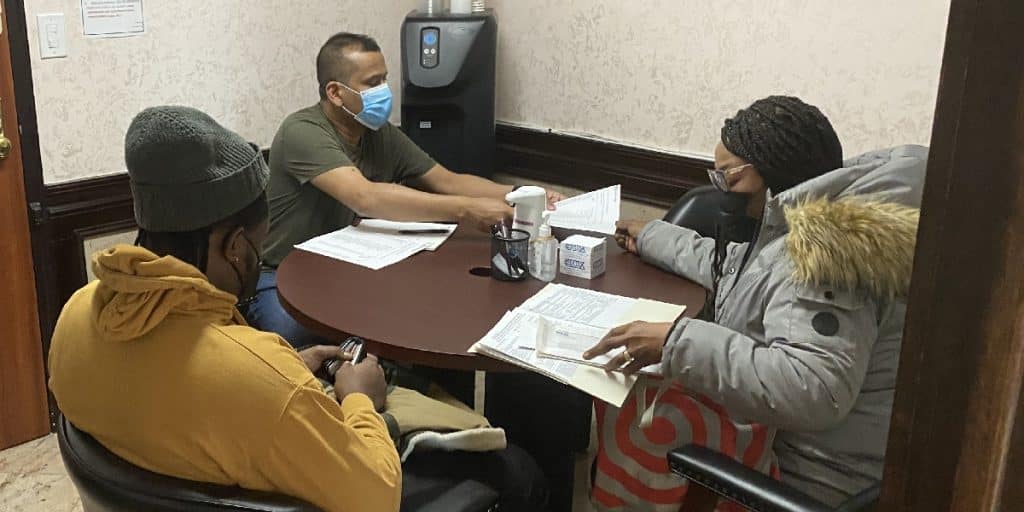

Despite the overall trend upward, mortgage interest rates fluctuate significantly over short intervals. For homeowners who have held back on refinancing or who have not previously qualified for a refinance mortgage may still have great opportunities because of the dips caused by these fluctuations. At MortgageDepot, our loan originators have helped many homeowners refinance their mortgages over the years. This includes helping homeowners who have not been able to qualify for a refinance loan elsewhere. Our skilled and knowledgeable loan originators are available to help you learn more about your current refinance options, and we can help you to lock in a competitive interest rate for your refinance as well.

Contact one of our loan consultants for more information.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!