Depending on where you live, you could pay thousands of dollars or more in closing costs when you buy a new home. Closing costs cover everything from prepaid property insurance and title insurance fees to an appraisal and more. You understandably want to reduce your out-of-pocket expenses as much as possible when you are preparing to buy a new home. While an appraisal is required for all home purchase loans, you may not have to pay for this expense yourself. Now, you may qualify for a no-cost appraisal when you apply through MortgageDepot. This could save you up to $600 in closing costs.

To take advantage of this exciting opportunity to save money on your upcoming purchase, your lending representative will need to take a few behind-the-scenes steps early in the process. These steps include gathering a copy of the sales contract, verifying the property taxes and working with you to get a quote for property insurance. In addition, the loan representative will need to lock your interest rate up-front. This means that you are securing your interest rate rather than allowing it to adjust with market conditions until closing.

The no-cost appraisal option is open to all homebuyers who are interested in purchasing a property for their primary residence. It is offered with FHA, VA, jumbo and conventional loans. Be aware that this money-saving opportunity is not available for refinance loan requests.

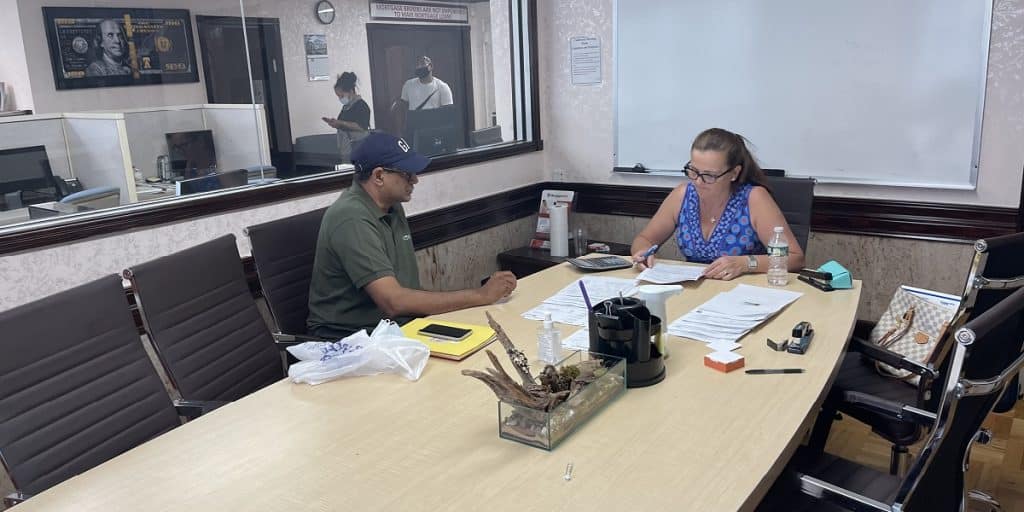

Are you interested in learning more about the no-cost appraisal opportunity? Do you want to know more about the loan programs and terms that you qualify for? At MortgageDepot, our loan associates are eager to help our customers get familiar with their options, and we can quickly complete a prequalification to get the ball rolling on your upcoming purchase. Contact our loan office today to explore your options in detail.

Connect with one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!