The housing market has been solid in areas across the country for several years thanks to very low interest rates and various other factors. However, mortgage rates have risen slightly across recent quarters, and this trend is expected to continue over the next year. If you have not yet locked in your low interest rate or made a new home purchase, you may be one of many people who are torn between renting and buying.

Homeownership comes with a slew of advantages, such as the ability to establish a fixed mortgage payment and to eventually own the home outright. You can generally expect to build equity in the home over the years, and you do not need to worry about being forced to move as long as you keep up with your mortgage payments. On the other hand, homeownership also comes with significant costs and time demands for upkeep and repairs. Relocating to a new home is increasingly complex because of the need to sell the home or to find a tenant first. In addition, while housing prices tend to trend upward, there are no guarantees that your new home’s value would increase during the years that you own it.

How can you confidently decide if you should rent or buy your next home? You need to consider your short-term and long-term plans related to your career and for your family. If you plan to relocate soon or if your family’s need for space will increase or decrease dramatically soon, renting may be a better option. In addition to analyzing these factors, you need to explore the housing market in your area. After reviewing online home listings, you can utilize a mortgage calculator to estimate affordability. If you can enjoy roughly the same housing payment by buying a home and your various family and career plans are aligned properly, now could be a suitable time to purchase a home.

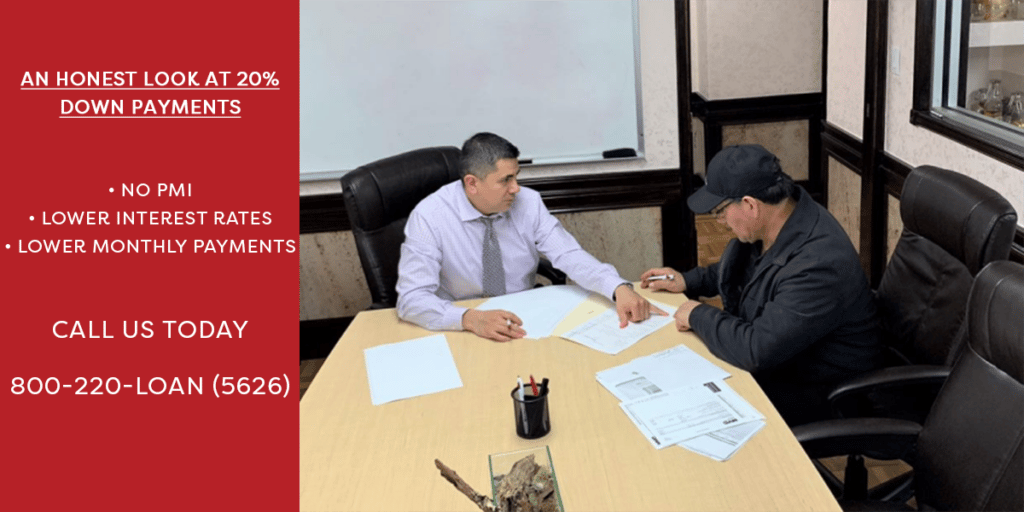

There are various other factors to consider, such as your ability to qualify for a mortgage. To learn more about the loan programs and terms that are available for your qualifications, connect with your mortgage lender.

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!