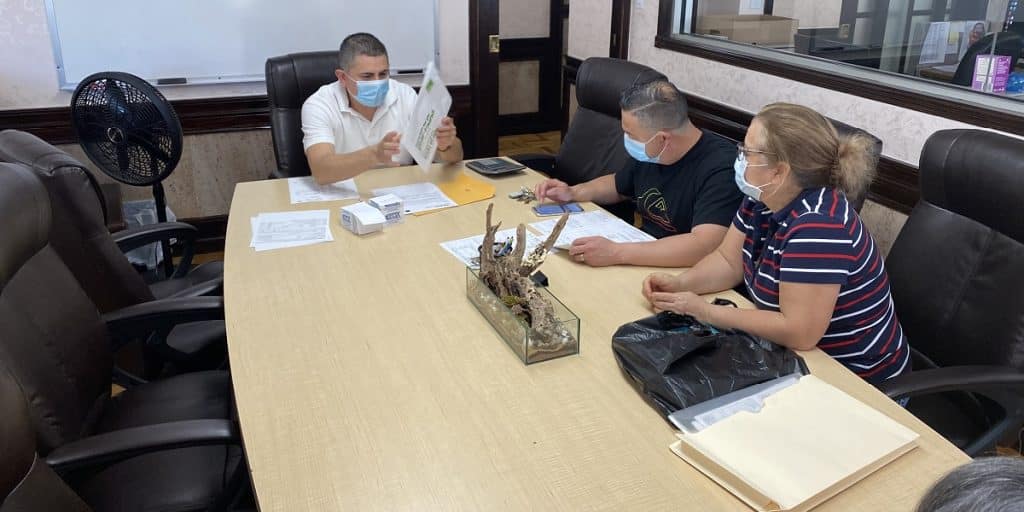

Every time a new client sits down at our desk, we embark on an adventure. We love working with clients who are new to the United States or planning to relocate to our country. They always have stories to tell, and we want them to have a seamless mortgage process like our domestic clients.

When it comes to using foreign funds to purchase a home in the U.S., things can get tricky. On a positive note, we work with lenders that allow borrowers to use funds from other countries to purchase domestic real estate.

Since we work with a diverse client base, we know this happens often. If you plan to use foreign funds to purchase real estate in the U.S., make MortgageDepot your first stop. Until then, we would like to give you an overview of what to expect if you fall into this category.

Our Requirements for Purchasing a Home Using Foreign Funds

If you need to use funds that originate outside of the U.S. or its territories to close on a piece of real estate, you’ll need to meet one of these two conditions:

- Condition #1: You must transfer the money into a U.S. or state-regulated financial institution, and the funds must be verified in U.S. dollars before closing.

Most banks will send money out of the country for you. If you can’t find a bank that will accommodate, contact us for guidance. - Condition #2: The combined value of the assets must be at least 20% greater than the amount needed for closing.

Here’s an example: If you need $150,000 to close on a piece of U.S. real estate, you would need to have at least $180,000 in total assets. The assets must be in U.S. dollars to meet this requirement.

Contact MortgageDepot Today!

Our diverse client base is one thing that makes us stand out from other mortgage brokers. If you plan to purchase a piece of U.S. real estate with foreign funds, contact us today to learn how to make your transaction a hassle-free experience!

Connect with one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!