Whether you are buying your first home in 2021 or you are preparing to upgrade or downsize, you need to know what to expect from this experience. Thanks to the current economic situation and the effects of the pandemic, the buying experience will be far different than it has been for other homebuyers in recent years.

Generally, housing prices are rather high, and they are expected to increase significantly over the next year. This is because of high demand and low inventory in many markets. At the same time, interest rates are expected to remain near record lows. For buyers, this means that you should get prequalified for your mortgage upfront. Understand what you can afford to buy before you start touring homes. A prequalification letter from your lender may motivate a seller to accept your offer.

Through the prequalification process, you may learn about personal financial issues that need to be addressed. These could include incorrect items on your credit report, insufficient funds to purchase a suitable home and more. Address all issues well in advance of your home search. Because the market is so competitive, you want to be in a great position to pull the trigger once you find the right house.

With a limited inventory of homes in many markets, give yourself more time to shop around and to find the right house. You also may need to be open to buying a fixer-upper. If you insist on finding a prime home, you may be involved in a bidding war with one or more other buyers. This could drive the price up. Because of this, consider looking at homes that are priced below the maximum amount that you are pre-qualified for.

While buying a home in 2021 may be challenging for many buyers, the effort may be worthwhile. Locking in a low mortgage rate this year can benefit your finances for many years to come.

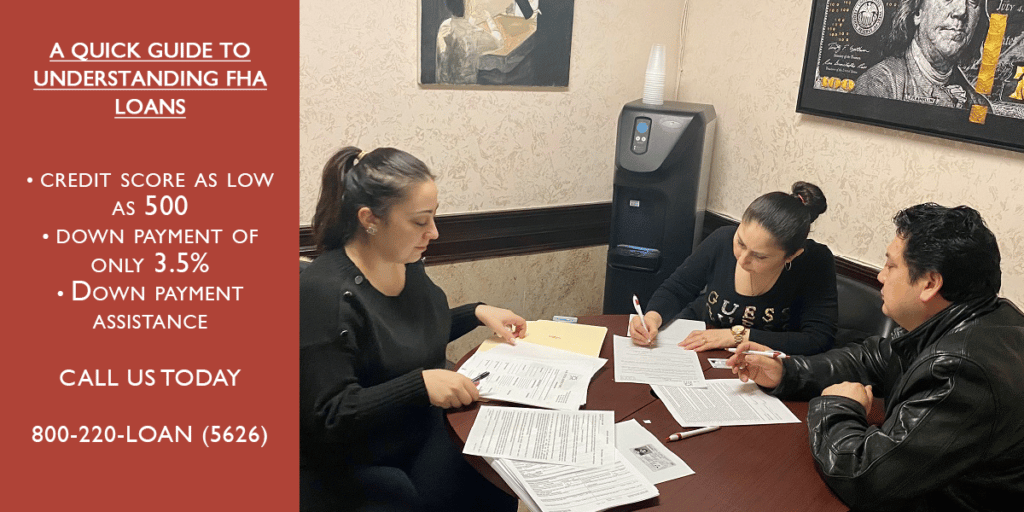

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!