Why Choose the VA Loan Program?

There are a number of reasons why a veteran should choose a VA loan over conventional loans. The flexibility is one of the factors that many veterans can associate with VA loans. Plus, the amount of VA benefits that are provided through the loan program only expand the flexibility of each program. That is why it is important to look deeper into VA loans and how they help veteran of the U.S. military.

Taking a Closer Look at VA Loans

The VA benefits provided by the loan program are far reaching and heavily outweigh the benefits of a conventional loan. First of all, VA loans do not look at a particular credit score but look at a payment history. That is why if a borrower has a poor credit score, they can still qualify. The amount of closing costs are practically nothing compared to conventional loans. For example, the veteran can roll the funding fee into the original principal balance instead of paying up front, and in some cases the veteran is exempt from paying the fee. The interest rates on a VA loan are usually prime rates, and unless the borrower has nearly perfect credit, veterans cannot obtain the prime rate on conventional loans. It is important to keep in mind that FHA loans mirror VA loan, so using the FHA route is a viable option.

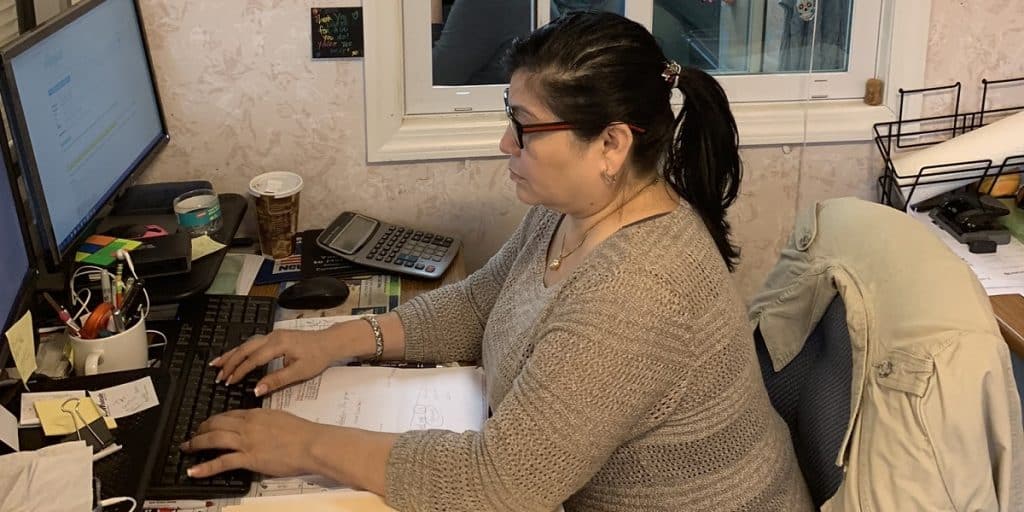

Using MortgageDepot for VA Loans

We are a leader in the mortgage industry, especially when it comes to dealing with VA and FHA loans. Based out of New York, we haves built a reputation for helping veterans who are looking to buy or refinance a loan through specific VA loan programs. We are a trusted name in the industry and answer any and all questions related to VA loans.

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!