Did you know that it is less expensive to buy shares in a cooperative building that buying a home using a conventional loan? A commercial coop mortgage allows you to pay shares for commercial space in a coop. You can use the loan to acquire or refinance retail or business space. For instance, you can pay for medical office space, restaurant space, music store space or a fitness center.

What are the Advantages of Coops?

There are many advantages attached to commercial coop acquisition or refinance. These include:

- You spend less to get the space you need.

- You enjoy tax benefits because the shares transform you into a property owner.

- You have more control over decision-making in the property.

- Closing costs are less than what you will pay for a commercial condominium.

- You get fixed or floating rates on the loan.

- You can get the loan for a term ranging from 5 – 25 years.

- You can use the loan to finance owner-occupied s well as investment properties.

These advantages make this loan appealing to a wide audience.

Closing Costs for Commercial Coops

The closing costs for these loans carry according to the size of the loan, the business use and the business type. The costs you meet include appraisal based on the square feet, loan fees (0-2 percent), lien search and bank attorney fees.

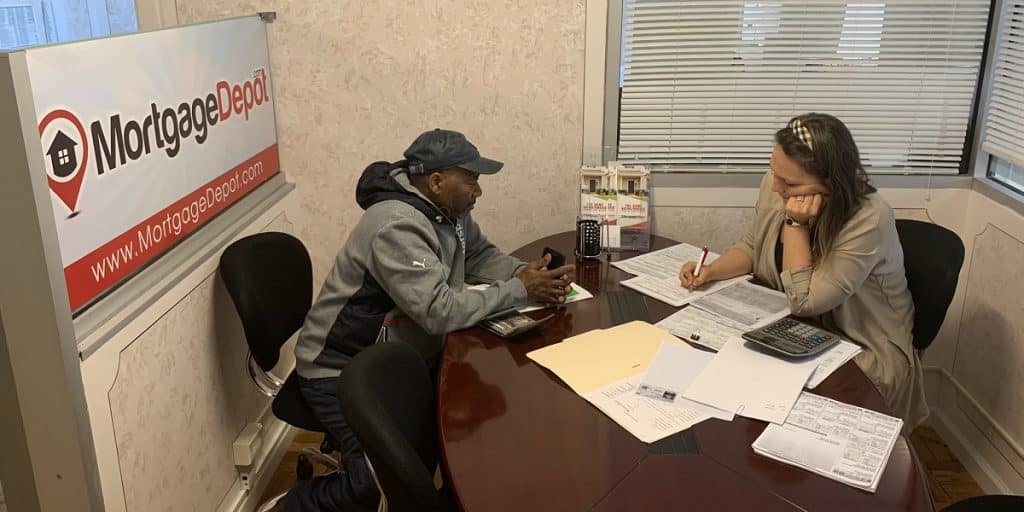

Why Should You Consult MortgageDepot?

Not all lenders are familiar with commercial co-op mortgages, and many challenges are associated with getting the finance to buy into a coop. However, our loan officers understand the specific characteristics of commercial coops. Additionally, we have extensive experience financing these property types. Our lenders offer the best possible financing terms for these commercial loans to make sure you meet your needs. bring us your problem for a quick solution.

Get in touch with one of our loan consultants for more information.

*This product is not regulated by the New York State Department of Financial Services

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!