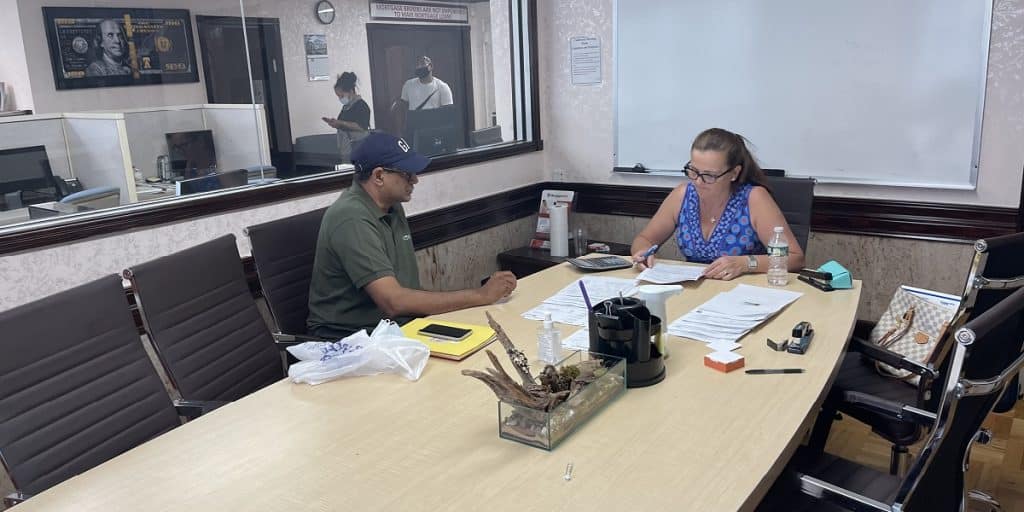

At MortgageDepot, we take pride in our ability to provide exceptional service to our clients while also meeting their varied needs. In fact, we work hard to establish lasting relationships that are rooted in our strong desire to meet our clients’ needs. Recently, we had the opportunity to work on a challenging loan request for a client we had been working with for the past eight years. The client recently came to us for a cash-out refinance loan request on a single-family rental property, and we were able to work through a variety of obstacles to once again meet her needs.

Credit and Income Challenges

Because of the pandemic, several of the tenants in the client’s other rental properties had not been paying rent for months on end. This created a situation where she was in forbearance. Often lenders will not approve a new loan request if a borrower has a history of not making payments on existing loan requests. More than that, this client could not provide personal income documentation. A rental income analysis on the subject property was also not available.

While many other mortgage brokers would not be interested in a loan request like this, we worked hard to find a way to get the client the cash-out funds that she needed. The solution was an asset-based loan that took into account the true value of the property, and this was combined with an exception for the forbearance issues.

Excellent Loan Terms

Ultimately, the Mortgage Loan Officer with who the client had established a long-term relationship was able to get her loan approved for 75 percent loan-to-value. Because of this, the client was able to obtain the cash-out proceeds that she needed.

About Boris Bast

Boris Bast has been meeting the mortgage lending needs of his clients for more than a decade. He actively strives to establish productive, long-term relationships with our clients at MortgageDepot while employing his deep professional knowledge to meet their needs.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!