Purchasing a home is an expensive endeavor. Even if you can easily afford to write a check for the monthly mortgage, it might take a while to save up for a down payment. Many people don’t have that kind of time. That’s why gift money can be a lifesaver to eager buyers.

Mortgages are largely based on the buyer’s income. Gift funds are a one-time sum of money that is not a stable part of regular earnings. How can a buyer successfully use gift funds to purchase their dream home?

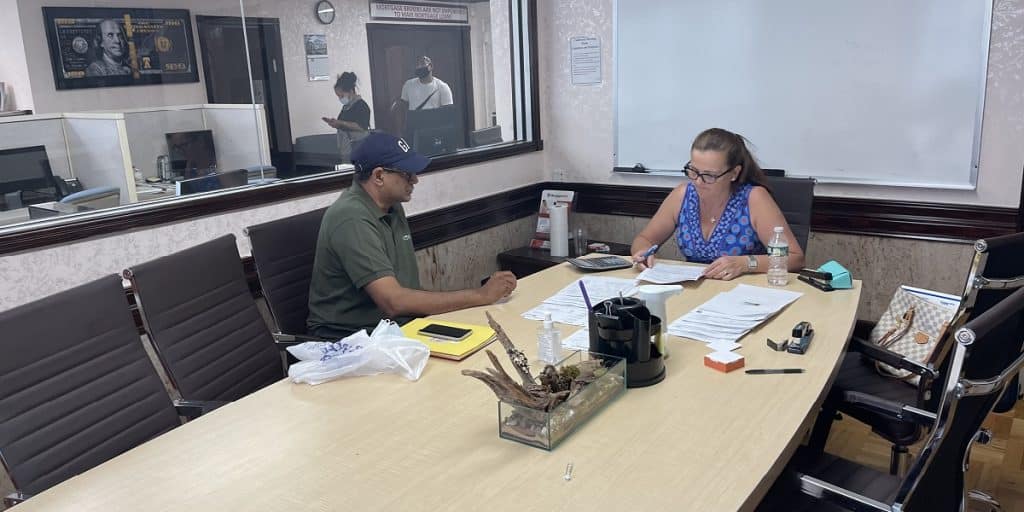

Using Gift Funds To Reach Your Real Estate Goals

When it comes to using gift funds to buy a home, countless special situations could affect your transaction. At MortgageDepot, we consider gift funds given by a borrower’s domestic partner or relative as the borrower’s own funds.

To use these gift funds to purchase a home, the buyer must meet these requirements:

- The borrower’s domestic partner, relative, fiancé or fiancée must have lived with the borrower for at least the last 12 months.

- The domestic partner or relative must intend to use the property in question as their primary residence.

- The domestic partner or relative must provide documentation stating the conditions listed above.

Appropriate documentation may include the borrower’s and domestic relative’s driver’s licenses, bank statements or other proof of address. MortgageDepot will assist clients in collecting the paperwork needed to qualify.

More About Gift Funds

To be considered a gift, this money must come with no repayment expectation. If the borrower is expected to pay the money back, it becomes a loan. Loans are accounted for differently in the mortgage process, so it is important to be clear on the terms of any money you receive to fund your home purchase.

Contact MortgageDepot Today!

If you’re ready to take the next step on your real estate journey, contact MortgageDepot. Our experienced loan officers will help you forge a path toward your real estate goals, even in the most challenging conditions!

Contact one of our loan consultants to learn more.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!