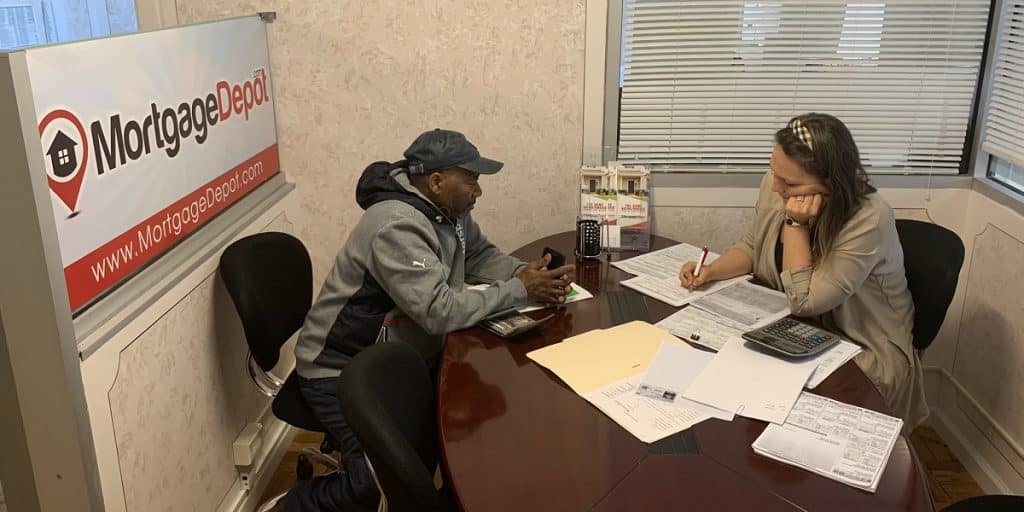

MortgageDepot takes pride in the ability of our mortgage loan originators to guide borrowers through the process of finding the financing options best suited for their needs. Increases in lending limits for FHA high balance loans means more of our borrowers in need of the reduced down payment requirements of FHA financing can now qualify for them.

Federal Housing Administration lending limits increased

The lending limits on FHA high balance loans have increased, but the amount of the increase depends on housing costs in the part of the country in which the loan is originated and the type of property being financed. For example, borrowers living or moving into what is designated as a low-cost area are subject to the following maximum loan amounts:

- Single unit property: $275,665

- Duplex property: $352,950

- Three-unit property: $426,625

- Four-unit property: $530,150

These loan amounts are based upon increases in the federal agency’s national conforming loan limits for different types of properties. The new limits are the following:

- Single unit property: $548,250

- Duplex property: $702,000

- Three-unit property: $848,500

- Four-unit property: $1,054,500

High balance loan amounts increase

FHA high balance loan limits have increased for those areas of the country in which housing costs are high. The new maximum loan amounts are as follows:

- Single unit property: $822,375

- Duplex property: $1,053,000

- Three-unit property: $1,272,750

- Four-unit property: $1,581,750

Contact MortgageDepot for your financing.

Speak to one of our mortgage loan originators to learn what MortgageDepot can offer when you need FHA high balance financing.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!