If you are thinking about applying for an FHA loan, you are not alone. FHA loans are well-known for being very competitive with simplified underwriting guidelines, but they are not suitable for everyone. One of the key factors to consider initially if you are thinking about applying for FHA loans are the FHA loan limits that are in place. These are minimum and maximum limits that are in place, and if your loan amount does not meet these requirements, you will not qualify for an FHA loan.

You may be wondering what the FHA loan limits are. They change periodically, and MortgageDepot stays on top of the changes to the FHA loan requirements. We are your local expert for all types of residential mortgages, and this includes FHA loans.

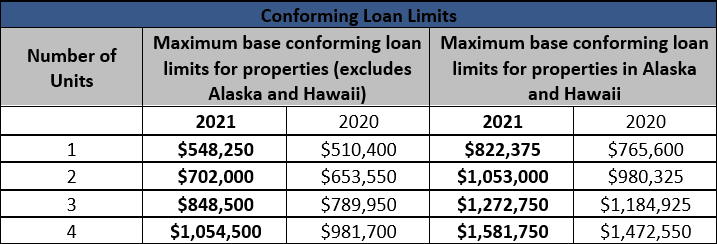

The current underwriting requirements for FHA loans state that:

- The minimum loan amount is $548,250

- The maximum loan amount is $822,375

- There are some exceptions to these rules based on the geographic location of the property

FHA loans may have strict minimum and maximum loan requirements, but they are also designed specifically to help you make it more affordable to purchase a new home. At MortgageDepot, we specialize in providing competitive residential loan programs to our valued customers, and we are excited to be able to offer FHA loans to you.

FHA loans also offer:

- Low interest rates

- Competitive loan-to-value requirements

- Affordable closing costs

- Quick closings

As you can see, there is plenty to love about FHA loans, and we are the mortgage team that you want working for you when you apply for your new loan. We are eager to answer all of your questions with honesty and integrity so that you can make a more informed decision about your mortgage.

Please contact us soon to begin learning more about FHA loan limits and other requirements in place for these loans, and we will begin working for you.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!